Self-Storage: A Burgeoning Real Estate Sector

Self-Storage presents a unique opportunity for investors looking to diversify their investment portfolio. Once the outsider of the real estate world and associated with rural plots of land and rows of garages, self-storage facilities have upgraded their look and functionality from their 20+ year history.

The Fastest Growing Real Estate Sector in the Last 40 Years

Self-Storage presents a unique opportunity for investors looking to diversify their portfolio. According to the Self Storage Association, a not-for-profit trade association representing the self-storage industry, the sector has been the fastest growing segment of the commercial real estate industry over the last 40 years². Once the outsider of the real estate world and associated with rural plots of land and rows of garages, self-storage facilities have upgraded their look and functionality from their 20+ year history, valuing this asset class at $40.73 billion in 2020 with the expectation to grow to $53.92 billion by 2026². The rural garage rows now emulate modern office buildings that reside in the heart of the urban core. The dusty exterior-accessed units are decreasing in popularity in favor of interior-accessed, well-lit, heated and cooled hallways that provide safety and security. The rental process is quick and convenient, often done completely on a computer or smartphone. Simply put, the self-storage industry is in a different league than in years past, positioned to provide future growth in the sector.

GenV: The Latest Generation of Storage Facilities

Storage began with the familiar looking rows of garages and shifted to more secure, fenced in facilities in the 1990s. This evolved into climate controlled facilities in the early 2000s. Now, most current projects are constructed vertically ranging from two to five story buildings on average. The term GenV or “Generation V” is an industry description of newly built, multi-story, climate-controlled, Class-A self-storage facilities located in dense and growing markets throughout the United States. The V depicts both the number five and the letter V, referencing the 5th generation of self-storage facilities containing the industry’s design and technological advances over its 50-year history and V as in, “vertical” characterizing the multi-story facilities built on small tracts of land in dense urban core markets.

This more vertical approach limited the need for larger sites allowing facilities to progress into the urban core, often strategically located next to retail developments and on major, high trafficked roads. These Class-A locations attract more traffic due to increased visibility and are more conveniently located to the desired customer base. Previously, storage facilities were routinely located on the edge of suburban areas; now newer storage facilities are becoming part of weekend errands given the proximity to retailers and urban destinations.

In comparison to older storage properties, GenV facilities command a premium in rental rates with an updated sleek design and amenities like electronic locks, access through smartphone apps, extended hours, bright lights, and video surveillance. The main offices in these facilities typically provide access to WiFi, property managers who can accept deliveries on tenants behalf, packing and moving supplies for sale, and dedicated areas for business tenants in need of a workspace after visiting their inventory housing unit.

Strong Demand Indicators and Growing Penetration Rates

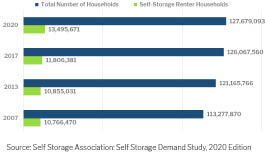

Strong demand for self-storage continues in 2021 after a 2020 which saw solid sector performance across the country. Demand indicators for this sector center around population growth and storage vacancy. Since 2005, 3.5 million more households rent self-storage units for a total of 13.5 million self-storage renting households, an all-time high³, 10.57% of total households.

Self-storage unit demand is typically driven by major life events such as relocation, job change, marriage, or divorce. Storage unit renters are now seeking out an extension of their home closets or garages as an alternative to purging their belongings or upsizing their home. Smaller-scale consumers with a need to store items ranging from holiday decorations to golf clubs to seasonal clothes can also store in small, well priced storage solutions such as a five-foot by five-foot units, averaging $1.88 per squarefoot4.

Rising population in most major markets coupled with more demand drivers than ever before should lead to a continued rising need for storage in densely populated, well trafficked areas.

COVID-19 Performance

During the pandemic, there was an overwhelming trend of deurbanization contrary to the preceding decades in large cities with a high concentration of people making it difficult for residents to socially distance.

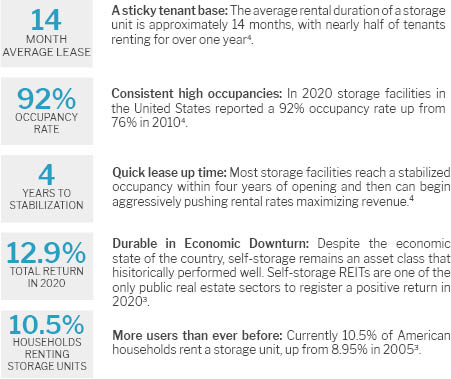

As most real estate sectors struggled amidst the lasting effects of the COVID-19 Pandemic with more questions and uncertainty ahead, self-storage endured and is well-positioned for the future. This asset class has historically performed well in times of financial strain as consumers look to storage units to provide extra space in their homes without turning to more expensive options. Self-storage REITs are one of the only public real estate sectors to register a positive return in 2020³.

Real Estate Leader

For more than 25+ years, the self-storage sector has been the best performing real estate sector for many reasons¹.

Combine these facts together with first-class management and quality of newer facilities mentioned above, and it’s apparent that self-storage can create consistent income opportunities for investors in the sector.

The Future of Self-Storage

As the industry continues to evolve, the future remains bright for self-storage. The unprecedented development cycle that began in late 2014 is now beginning to taper off and markets that were hit by new supply are starting to reach an equilibrium where supply is meeting demand as opposed to supply being greater than demand. The COVID-19 Pandemic halted many planned projects further helping supply absorption. The self-storage sector was valued at $40.73 billion in 2020 and is expected to grow to $53.92 billion by 2026¹. The continued urbanization of the modern storage facility and the increase in percentage of households that use the product should help push this sector to new heights. Self-storage, once thought to be on the fringe the real estate investing world, is now firmly planted amongst the other major sectors.

Sources

1 Self-Storage Market – Growth, Trends, COVID-19 Impact, And Forecasts (2021 – 2026) https://www.mordorintelligence.com/industryreports/self-storage-market

2 Self Storage Association

3 Source: FTSETM, Nareit®: https://www.reit.com/sites/default/files/returns/prop.pdf

4 Storage Demand Statistics, Neighbor: https://www.neighbor.com/storage-blog/self-storage-industry-statistics/

5 Data sources: Coronavirus COVID-19 Global Cases by the Center for Systems Science and Engineering (CSSE) at Johns Hopkins

University; the Census American Community Survey; the Department of Health and Human Services; and the Bureau of Labor and Statistics.

6 Self Storage Association: Demand Study, 2020 Edition

Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without the permission of NexPoint. The information contained in this document is subject to change without notice. The above commentary is presented for informational purposes only. Past performance does not guarantee future results.

This commentary is provided as general information only and is in no way intended as investment advice, investment research, a research report or a recommendation. Any decision to invest or take any other action with respect to the subjects discussed in this commentary may involve risks not discussed herein and any such decisions should not be based solely on the information contained in this document. It should not be assumed that any subjects discussed in this commentary will increase in value. NexPoint will not accept liability for any loss or damage, including, without limitation, any loss of profit that may arise directly or indirectly from use of or reliance on such information. Statements in this communication may include forward-looking information and/or may be based on various assumptions. The forwardlooking statements and other views or opinions expressed herein are made as of the date of this presentation. Actual future results or occurrences may differ significantly from those anticipated and there is no guarantee that any particular outcome will come to pass.

The statements made herein are subject to change at any time. NexPoint disclaims any obligation to update or revise any statements or views expressed herein.

No representation or warranty is made concerning the completeness or accuracy of the information contained herein. Some or all of the information provided herein may be or be based on statements of opinion. In addition, certain information provided herein may be based on third-party sources, which information, although believed to be accurate, has not been independently verified.

The information provided herein is not intended to be, nor should it be construed as an offer to sell or a solicitation of any offer to buy any securities. This commentary has not been reviewed or approved by any regulatory authority and has been prepared without regard to the individual financial circumstances or objectives of persons who may receive it. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. NexPoint encourages any person considering any action relating to real estate topics discussed herein to seek the advice of a financial advisor.

An investment in self-storage includes risks associated with owning, financing, operating and leasing self-storage facilities, and real estate generally; risks associated with the self-storage industry, such as significant occupancy rate fluctuations and relatively low capital requirements or other barriers to entry for competing properties; risks associated with the impact of pandemics, including the COVID-19 pandemic, and the economics of the communities in which the properties exist; risks related to competition from properties similar to and near the properties; and the possibility of environmental risks related to the properties.