DSTS/1031 Exchanges

A Complete Guide to DSTs and 1031 Exchanges

What is a 1031 Exchange?

A 1031 exchange is an IRS-recognized tax deferral strategy that allows an investor to sell an investment property and acquire a similar property with the intent to defer capital gains and depreciation recapture taxes.

The Transaction is Named for internal revenue code 1031, which states:

1031 exchanges can be structured through Delaware Statutory Trusts (DSTs), investment vehicles used to hold commercial real estate assets. DSTs can offer accredited investors an effective real estate investment solution with several potential benefits.

What is a Delaware Statutory Trust (DST)?

A Delaware Statutory Trust(DST) is a legal entity created under Delaware law as a trust that holds title to 100% of the interest in real property.

Investors acquire a beneficial interest in the trust, with limited personal liability for the underlying assets. DSTs differ from Tenancy in Commons(TICs), Another 1031

With a DST, investors must keep the following things in mind regarding control and liability on the assets in exchange:

-

IRS GOVERNANCE

Investors need to assure that the sponsor will be compliant with IRS guidelines -

VOTING RIGHTS

Investors will forfeit all voting rights for decision making to Trust manager -

EXPENSES

Investors will incur no additional LLC costs -

LIABILITY

Investors will be limited on liability to invested equity -

DEBT

Investors will not personally assume liability for property-level debt -

OWNERSHIP

Investors will own a beneficial interest in the trust

Objectives of 1031 DST Exchanges

A 1031 Exchange is an IRS-recognized tax deferral strategy that allows an investor to sell an investment property and acquire a similar property with the intent to defer capital gains and depreciation recapture taxes. More investors are expected to seek a tax-deferred solution with respect to the sale of real property since tax rates increased on capital gains in 2013.

- Tax Deferral

- Potentially tax-efficient, non-correlating income

- Potential capital appreciation

- Access to quality real estate through fractional ownership

* There is no guarantee that this objective will be achieved or that a loss of capital will be avoided

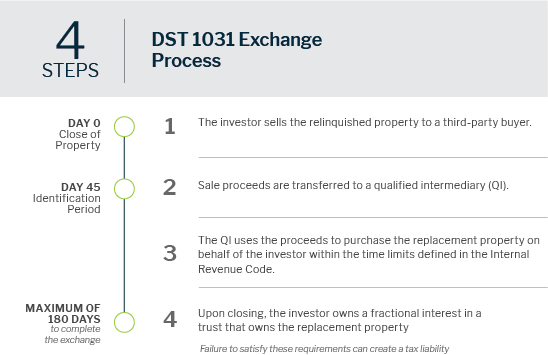

The Process: Investing in DST Exchange Trust Properties

Ownership Options

With a 1031 exchange, investors can choose between whole-property purchases and fractionally-owned purchases. One advantage of fractional ownership interest in commercial assets that can be an attractive alternative to purchasing a wholly-owned property is the ability to close within the short 180-day time limit and passive ownership (investor is not actively operating the property).

Potential Benefits of a Delaware Statutory Trust

With varied benefits of ownership through trusts, DSTs have become increasingly popular for executing 1031 exchanges.

Here are a few potential Benefits:

- No personal loan recourse for investors on property-level debt

- Lower minimum investment

- Potential for multi-property diversification

- Multiple, more flexible, exit strategies

Potential Risks of a Delaware Statutory Trust

Along with the benefits, investors should be aware of several potential risks associated with DST exchange programs.

Here are a few potential RISKS:

- Limited transferability, lack of liquidity and less control over operating decisions for individual investors

- If the trustee violates one of the mandatory tax restrictions, investor income could become immediately taxable

- The tax code could change, negatively impacting the tax deferment

IMPORTANT RISKS AND DISCLOSURES

NexPoint is a leading alternative investment platform and multi-billion dollar integrated asset manager that provides differentiated access to alternatives through a range of investment offerings, including publicly traded real estate investment trusts (REITs), private placements, 1031 exchanges, closed-end funds, interval funds, and a business development company (BDC). The Advisor’s management team has extensive real estate experience, having completed billions of gross real estate acquisitions since the beginning of 2012.

FOR EDUCATIONAL USE ONLY