Introduction

There are a number of registered fund structures, each with potential benefits and potential risks. Interval funds combine elements of various common investment vehicles and bring them together in a way that can be supportive of both long-term investment strategies and investor needs.

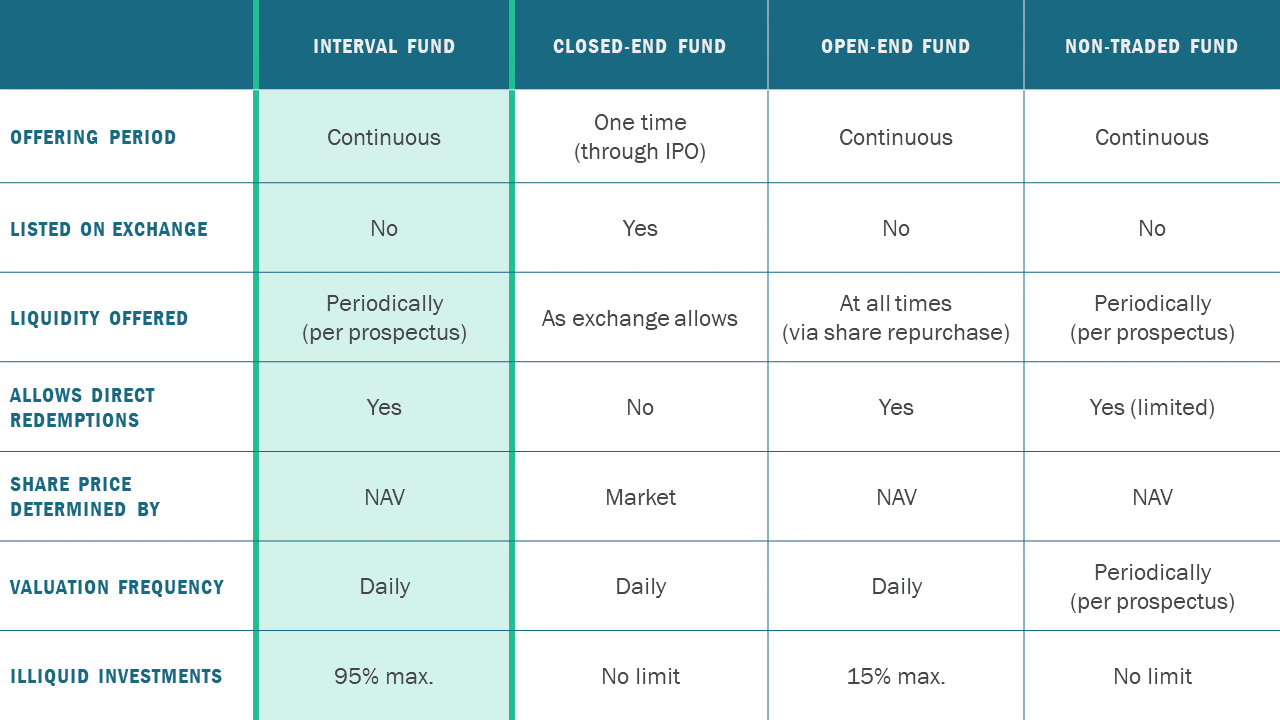

The following includes an overview of various fund structures and explores the roles interval funds play in the universe of registered funds.

Key Terms

Close-End Funds

A closed-end fund is a publicly traded investment company that raises a fixed amount of capital at one time through an initial public offering (IPO). It is structured, listed, and traded like a stock on a stock exchange, with the share price determined by market value.

Open-End Fund

An open-end fund is a type of mutual fund that can continuously issue new shares. The funds buy back shares when investors wish to redeem. Shares are purchased and sold at a price based on the fund’s net asset value (NAV).

Interval Fund

An interval fund is legally classified as a closed-end fund, however it is different from a traditional closed-end fund. Interval funds offer daily investments; however, only a certain percentage of shares are available for redemption at predetermined intervals. Similar to the open-end structure, share price is determined by the fund’s NAV.

Non-Traded Fund

A non-traded fund, such as a non-traded business development company (BDC) or a non-traded real estate investment trust (REIT), is a continuously offered fund that does not trade on a securities exchange. Non-traded funds can be illiquid for long periods of time and offer limited redemptions. Investors typically seek non-traded funds as a long-term investment for income distribution.

Key Characteristics

Open-end funds, which many investors know as mutual funds, are commonplace in the investment industry. They are often contrasted with closed-end funds, which typically target a more sophisticated audience, with different risk profiles and liquidity characteristics. Each offers distinct features that, depending on individual investment objectives and the underlying strategy, can be beneficial.

Interval funds provide a structure that incorporates aspects of both open- and closed-end funds. Interval funds allow daily investments; however, they only offer periodic redemptions (typically quarterly) through a repurchase offer program.

By offering periodic redemptions rather than daily redemptions the fund can invest in more illiquid, higher-risk assets, which are more suitable to long-term investors. This makes interval funds similar to non-traded funds, another type of investment vehicle; however, unlike non-traded funds, interval funds must offer at least 5% at each quarterly redemption.

Structure Comparison