NexPoint Hughes DST

NexPoint believes that this Offering presents an attractive long-term investment opportunity due to favorable population growth, steady demographic income, nearby retail and entertainment drivers, continued and strengthening demand for multifamily assets, quality of the asset, and high physical occupancy, all in the the entertainment capital of the world.

LEARN MORE

MARKETING MATERIALS

Client Materials

Client Brochure

Client Fact Sheet

DST Education

PPM

Subscription Agreement

OFFERING SNAPSHOT

Multifamily Offering in Prime Location Presents an Attractive Long-Term Investment Opportunity

Acquisition Details

| Total Acquisition Cost* | $188,276,415 |

| Total Controlled Reserves | $5,325,000 |

| Lender Reserves** | $518,164 |

| Total Capitalization | $204,896,632 |

Highlights of the Trust

| Offering Size | $115,262,632 |

| Minimum Purchase -Cash | $100,000 |

| Minimum Purchase -1031 | $100,000 |

| Suitability | Accredited Investor Only |

Loan Information

| Leverage to Investors | 43.75% |

| Interest Rate | 3.52% Fixed Rate |

| Loan Term | 120 Months |

| Amortization | Interest Only for Full Term |

**The Total Acquisition Cost includes the purchase price of the Property, Loan-Related Costs, and Other Closing Costs.

** Lender Reserves refers to the Replacement Reserve which was required by the Lender.

There are substantial risks in any investment program. See “Risk Factors” on page 16 of the PPM for a discussion of the risk relevant to the Offering. Distributions are not guaranteed.

Please review the entire PPM prior to investing. This material does not constitute an offer to sell and is authorized for use only when accompanied or preceded by the PPM. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential Purchasers must read the PPM and no person may invest without acknowledging the receipt and complete review of the PPM.

MULTIFAMILY DST OFFERING

NexPoint Hughes DST Featured Videos:

Las Vegas

The Las Vegas MSA contains the largest concentration of people in the State of Nevada and the 26th most populous city in the U.S1.

Rising Population

The Las Vegas MSA has experienced annual population growth of 1.6% since 2010, which exceeds population growth in the State of Nevada over that period.

Steady Income

40.4% of households in the Las Vegas MSA earn less than $50,000 annually, leading to a higher percentage of residents in need of rental solutions.

Employment Epicenter

Major employers include: International Gaming Technology, Ultimate Fighting Championship, MGM Resorts International. The aforementioned companies have a combined market capitalization of over $35 billion, attracting high earning employees.

Diverse Housing Stock

The bulk of housing in the Las Vegas MSA is concentrated in single-family homes which comprise 63.6% of the inventory. For those seeking a more urban housing option, this offering provides luxury multifamily living in the Las Vegas epicenter of nightlife.

Las Vegas MSA

Local Area

417,090

Total 2021 Population

*5 Miles

1.3

Miles from the lively Las Vegas Strip

8

Minutes to McCarran International

#21

Fastest Growing Places1

1. Las Vegas, NV: https://realestate.usnews.com/places/nevada/las-vegas

NexPoint Hughes DST

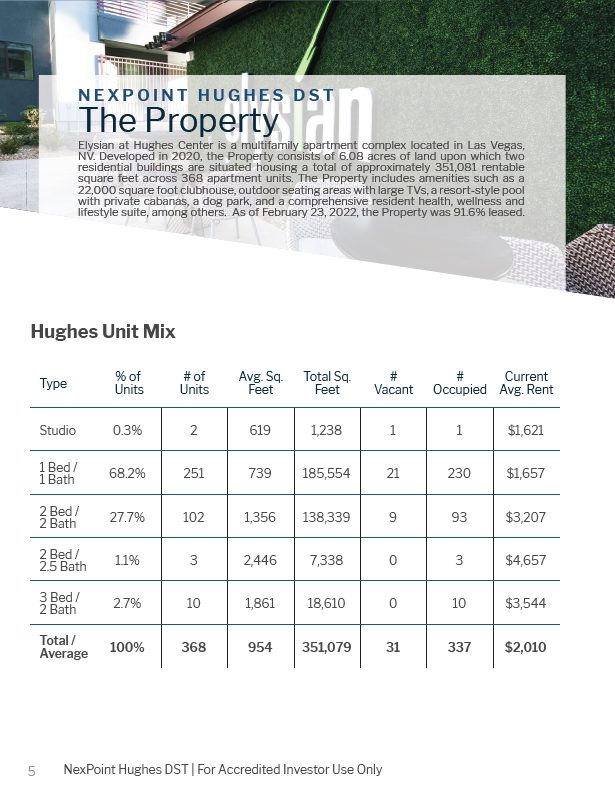

The Property

The Property, “Ely at Hughes Center” is a multifamily apartment complex located in Las Vegas, NV. Developed in 2020, the Property consists of 6.08 acres of land upon which two residential buildings are situated, housing a total of approximately 351,081 rentable square feet across 368 apartment units. The Property includes amenities such as a 22,000 square foot clubhouse, outdoor seating areas with large TVs, a resort-style pool with private cabanas, a dog park, and a comprehensive resident health, wellness and lifestyle suite, among others. As of February 23, 2022, the Property was 91.6% leased.

Unit Amenities

Every unit includes 9-foot ceilings, contemporary designer fixtures and hardware including upgraded cabinetry and quartz countertops in all kitchens and bathrooms, stainless steel appliances, over-sized tubs, full size showers, spacious balconies offering pool, courtyard and Strip views and state-of-the-art LED lighting throughout.

Community Amenities

The Property boasts several community amenities located throughout including: 22,000+ square foot clubhouse, a 5,065 square foot indoor and outdoor sky lounge, a comprehensive resident health, wellness and lifestyle suite, a resort-style pool with private cabanas, concierge services, and well-appointed unit interiors among others.

Class-A Property

The property features luxurious amenities including community perks such as many entertaining areas, fitness center and an outdoor pool as well as many spacious in-unit amenities.

Prime Location

The Property is located in the Las Vegas MSA, a thriving market supported by tourists and residents in the region’s thriving shopping and convention sectors.

Experienced Property Management

The property is managed by the Calida Group, a leading investor, and operator of multifamily real estate properties in the western United States.

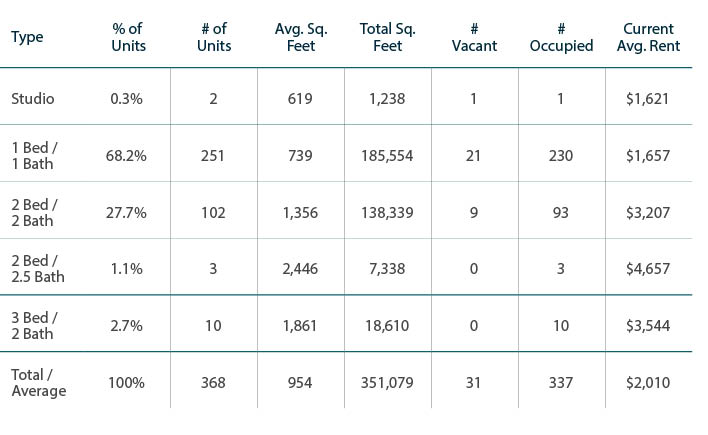

Hughes Unit Mix

The Developer

The Calida Group1

The Calida Group (“Calida”) and its affiliates will be involved in certain aspects of the Offering which provides an opportunity to collaborate with a proven Las Vegas apartment operator/ developer. By holding itself to the highest standards of quality, design, risk management and reporting, Calida challenges the perception of apartment living by developing designs and creating experience-driven amenities that seamlessly fit into residents’ fast-paced lives. Calida differentiates itself from the competition through thoughtful design and services, offering a chic, fun and urban environment not found at other luxury apartment home communities.

2007

TENURED

OPERATOR

Calida has been in operation since 2007 and has forged partnerships with some of the nation’s largest financial institutions.

Best of Las Vegas

“SIMPLY THE BEST”

“The Elysian Living” properties developed by Calida were named “Best Apartment Complex” in Las Vegas in the 2021 Las Vegas Review-Journal.

19,571

PORTFOLIO UNITS

Calida serves as the Operator/Developer for 19,571 total units across their platform.

MULTIFAMILY SOLUTIONS

The NexPoint Approach

Based in Dallas, Texas, NexPoint is a multibillion-dollar integrated alternative asset manager. NexPoint has extensive real estate experience, having completed $15 billion in gross real estate acquisitions and currently managing $4.25 billion of multifamily assets as of December 31, 2021, inclusive of affiliates. NexPoint’s deep roots in multifamily have served as the foundation for its DST/1031 Exchange business and enabled the firm to meet the rising investor demand for tax-advantaged real estate offerings.

Professional On-Site Management

NexPoint has a history of exclusive partnerships with first-in-class property management for its multifamily assets. Greystar serves as property manager for the Property, accompanied by their 2,675 communities under management and their team’s expert knowledge of local market dynamics.

Capital Markets Expertise

Leveraging our integrated investment platform and affiliate network, NexPoint has access to a range of investment resources that complement our core real estate and credit capabilities. This is evident in our capital markets expertise, which has enabled us to bring creative financing solutions to otherwise complex transactions.

Value-Add Approach

NexPoint acquires Class B+/A multifamily real estate properties, typically with a value-add component, where we can invest capital to provide “lifestyle” amenities to workforce housing or newly developed properties. Our value-add strategy seeks to provide a safe, clean, and affordable home to our residents.

Experts in Real Estate

Real Estate Track Record1

1. Real estate assets as of 03/31/2024, inclusive of affiliates 2. Real estate assets acquired from January 1, 2012 to March 31, 2024, inclusive of affiliates.

EXPERTS IN REAL ESTATE

NexPoint Management Team

Matthew McGraner

Chief Investment Officer

Mr. McGraner is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. With over ten years of real estate, private equity and legal experience, his primary responsibilities are to lead the strategic direction and operations of the real estate platform at NexPoint. acquisitions. Mr. McGraner has led the acquisition and financing of approximately $16.5 billion of real estate investments.

Brian Mitts

Chief Financial Officer

Mr. Mitts is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. Currently, Mr. Mitts leads NexPoint’s financial reporting and accounting teams and is integral in financing and capital allocation decisions. Mr. Mitts was also a co-founder of NREA, as well as NXRT and NexPoint Advisors, L.P., the parent of NREA. He has worked for NREA or one of its affiliates since 2007.

DC Sauter

General Counsel

Mr. Sauter is General Counsel, Real Estate for NexPoint Advisors, L.P. Prior to joining NexPoint in February 2020, he was a partner with Wick Phillips in Dallas, where his practice focused on all aspects of commercial real estate, including acquisitions, dispositions, entitlements, construction, financing, and leasing of industrial, office, retail, hotel and multifamily assets. In addition to transactional matters, Mr. Sauter has significant experience in complex commercial disputes, foreclosures, and workouts.

Disclosures & Risks

Any investment in NexPoint Hughes DST is highly speculative, illiquid, and involves a high degree of risk, including the potential loss of your entire investment. The photos in this brochure are of the actual Property in this Offering.

There are substantial risks in any investment program. See “Risk Factors” on page 16 of the accompanying PPM for a discussion of the risks relevant to this Offering. Distributions are not guaranteed. Please review the entire PPM prior to investing. This material does not constitute an offer to sell and is authorized for use only when accompanied or preceded by the PPM. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM.

An investment in an Interest is highly speculative and involves substantial risks including, but not limited to:

• this is a “best-efforts” Offering with no minimum raise or minimum escrow requirements;

• the lack of liquidity and/or a public market of the Interests;

• the holding of a beneficial interest in the Trust with no voting rights with respect to the management or operations of the Trust or in connection with the sale of the Property;

• risks associated with owning, financing, operating and leasing a multifamily apartment complex and real estate generally in the Las Vegas–Henderson-Paradise, Nevada Metropolitan Statistical Area (the “Las Vegas MSA”);

• risks associated with the impact of pandemics, including the COVID-19 pandemic, on the Property and the economy in which the Property exists;

• the Trust depends on the Master Tenant for revenue, and the Master Tenant depends on the end-user tenants for revenue and thus any default by the Master Tenant or the end-user tenants will adversely affect the Trust’s operations;

• performance of the Master Tenant under the Master Lease, including the potential for the Master Tenant to defer a portion of rent payable under the Master Lease;

• reliance on the Master Tenant and the Property Manager engaged by the Master Tenant, to manage the Property;

• risks associated with the Sponsor funding the Demand Note that capitalizes the Master Tenant;

• risks relating to the terms of the financing for the Property, including the use of leverage;

• lack of diversity of investment;

• the existence of various conflicts of interest among the Sponsor, the Trust, the Master Tenant, the Property Manager, and their affiliates;

• material tax risks, including treatment of the Interests for purposes of Code Section 1031 and the use of exchange funds to pay acquisition costs, which may result in taxable boot;

• the Interests not being registered with the Securities and Exchange Commission (the “SEC”) or any state securities commissions;

• risks relating to the costs of compliance with laws, rules and regulations applicable to the Property;

• risks related to competition from properties similar to and near the Property;

• risks related to wind and other natural weather events, which increases the risk of damage to the Property; and

• the possibility of environmental risks related to the Property.

NexPoint Securities, Inc., an entity under common control with the Sponsor, serves as the Managing Broker-Dealer of the Offering. The Managing Broker-Dealer was formed in November 2013 and is registered as a broker-dealer with the SEC and is a member of FINRA/SIPC.